Friends,

Winter weather locked down several parts of the state this week, including Senate District 9, as schools and other facilities closed for safety. The roads, however, remained mostly open, with Texas travelers encountering icy conditions and major traffic delays due to collisions.

The winter weather often increases traffic accidents, along with the potential for fraud and abuse. As we await the comprehensive recap for 2025, we are taking a look back at insurance fraud data from 2024 and its impact on rising costs for Texans.

Kicking things off this week, though, is CEO Ryan Patrick with an interview on the Chad Hasty Show in West Texas.

Ryan Patrick joined the Chad Hasty Show in West Texas this week to discuss what he’s calling “TLR 2.0” and why tort reform is once again becoming a national affordability issue.

During the conversation, Ryan explained how rising insurance costs are being driven by excessive litigation and unpredictable courts, and why states like Florida and Georgia are already seeing relief after passing meaningful reforms. He also emphasized that Texas cannot afford to lose its competitive edge as families feel the squeeze from higher premiums and fewer insurance options.

Ryan also outlined TLR’s role in the current election cycle, supporting lawmakers who understand that fair courts are essential to economic growth, job creation, and keeping Texas affordable for the long term.

Click here to listen to the full interview with Ryan Patrick on the Chad Hasty Show.

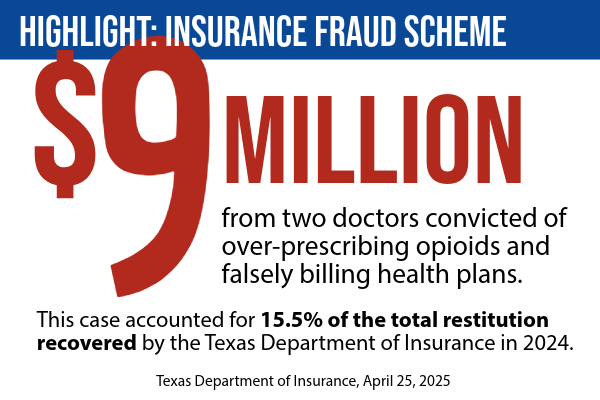

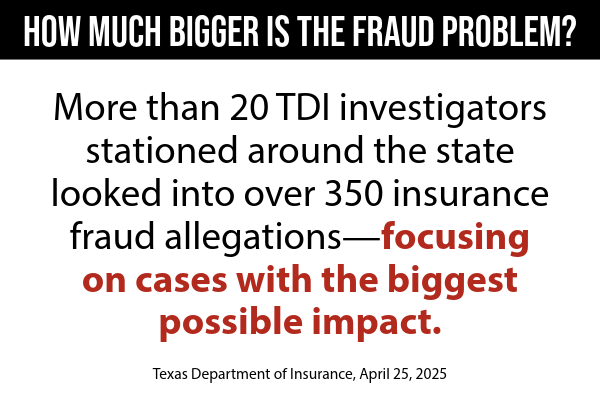

The Texas Department of Insurance (TDI) announced in March 2025 that it had recovered $58 million in restitution from fraud investigations the previous year. A comprehensive report outlined investigations into over 350 fraud cases in the same calendar year.

Included in the announcement was a highlighted conviction of two physicians who were found to be over-prescribing and fraudulently billing health insurers. In addition to jail time and the revocation of their medical licenses, the doctors were ordered to pay $9 million in restitution.

A comprehensive 2025 report is not yet available, but the ongoing civil action by major insurers in Texas and around the country points to ongoing problems with insurance fraud. In November, Allstate filed a claim against clinics in North Texas, alleging they fraudulently inflated medical costs for unnecessary and unreasonable services. Other major insurers have filed similar claims in Texas in 2020 and in Florida within the past several months.

The combination of public and private actions points to a larger problem in Texas, and elsewhere. But how much bigger is the fraud problem in the Lone Star State? The 350 complaints may just be the tip of the iceberg.

An independent review of TDI dispositions in 2025 found that insurance fraud accounted for over 22% of cases, while theft accounted for the majority at nearly 42%. This, however, is a summary of cases from years past, not newly initiated investigations. Estimated total restitution and fines for 2025 were nearly $1.1 million.

TLR will continue to monitor these reports and provide updates. With reports of historic fraud and heightened calls for transparency in other states, Texas lawmakers may increase vigilance in the next legislative session.

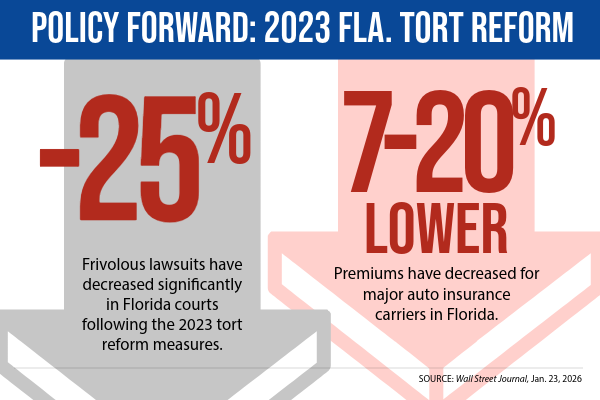

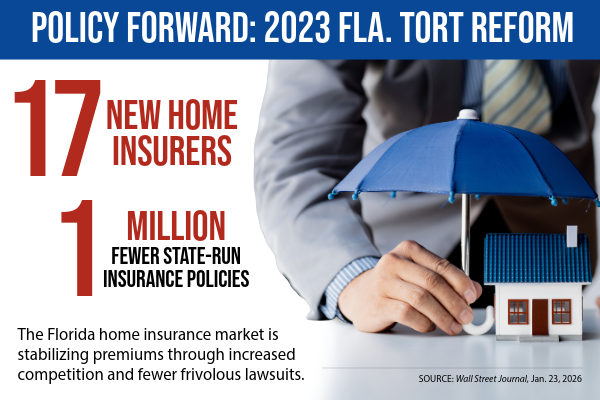

As new data continues to come out about the effects of tort reform in Florida, reform advocates are warning of attempts to undo those gains in the ongoing legislative session. As this editorial lays out, the wins for Florida consumers and affordability advocates is staggering, with lawsuits dropping 25% following 2023 reforms.

Consumers are benefiting with major carriers announcing significant refunds and cuts of 7-20% in auto insurance premiums over the past two years. Another component of these changes is the increase in competition for Floridians, as new home insurance carriers re-entered the market after years of out-sized jackpot verdicts.

👉 Read more about why Florida is winning, and what it could lose if tort reforms get reversed

Affordability is increasingly at the center of Texas politics, and Senate District 9 is no exception. Rising insurance costs and the growing influence of lawsuit abuse are affecting families and employers. The outcome of this special election will help determine whether Texas defends a fair, predictable legal system or whether the pressures driving higher costs remain unchecked.

The Early Voting period for the Senate District 9 Special Election closed Tuesday, despite disruptions caused by winter weather over the weekend. Polls closed on Sunday and did not reopen until 10 a.m. Monday, according to Tarrant County Elections.

Texans for Lawsuit Reform PAC has endorsed Leigh Wambsganss, who will stand up to lawsuit abuse and fight for affordability for Texas families.

👉 Election Day: Saturday, January 31

👉 Voting Locations